Layout Block - Banner benefits - particulier - assurer

Layout Block - Green Title H2

Layout Block - Text

Raiffeisen offers R-Vie Pension so you can look forward to retirement with full peace-of-mind. R-Vie Pension is open to anyone aged 18 to 65 and is a supplementary savings scheme for your retirement, offering very welcome tax benefits applicable immediately.

Text with Image

R-Vie Pension (in collaboration with our partner Foyer-vie):

- Build up your savings capital through regular payments into the Foyer Group's CapitalatWork funds.

- Support companies that take a responsible approach by choosing two responsible funds: ESG Equities and ESG Bonds.

Capital guaranteed up to 50%

Your investments can be split between variable capital and capital protected vehicles (up to a limit of 50%) depending on your financial ambitions and your risk tolerance level.

Layout Block - Green Title H2

Layout Block - Text

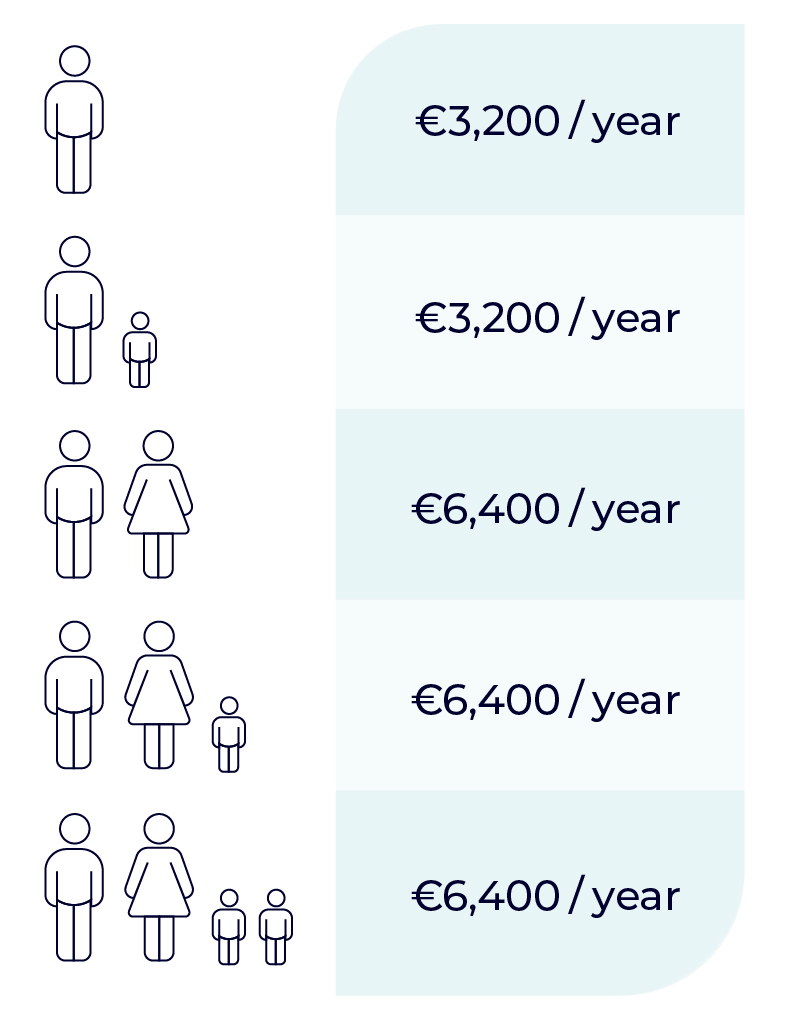

Article 111bis of the amended law on income tax provides for annual income tax deductions. The upper limit for tax deductibility is EUR 3,200 per year, regardless of the taxpayer’s age.

Layout Block - Green Title H2

Layout Block - Text

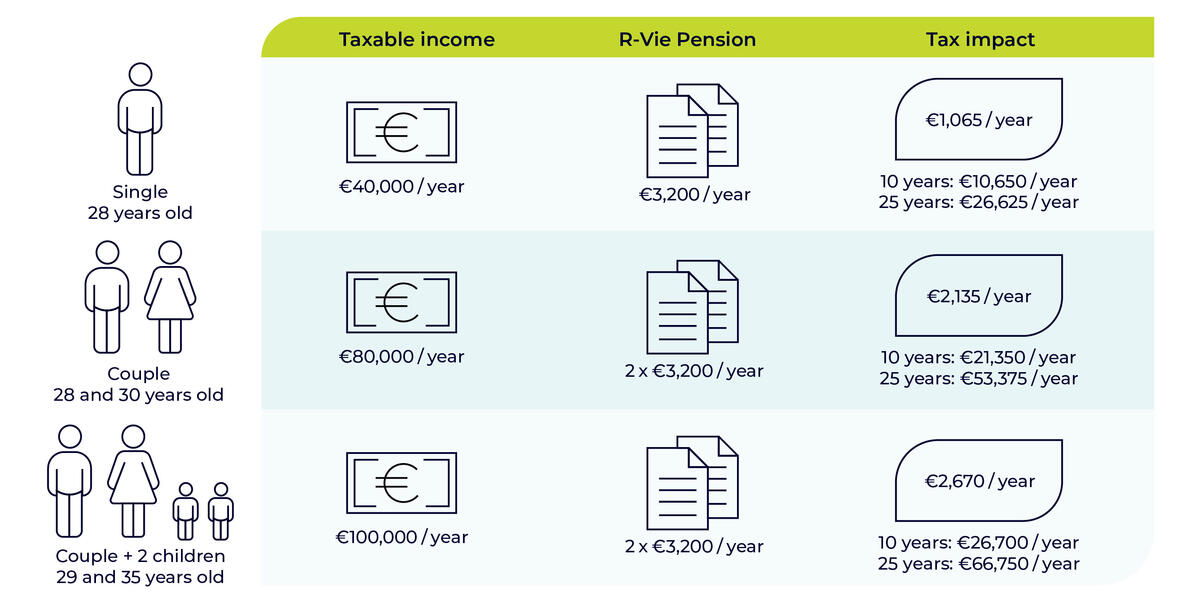

The table below provides information on the maximum annual tax impact.

Assumptions:

- Presence of another product cancelling out the special expenses package.

- The tax impact on leaving is not taken into account.

Layout Block - Green Title H2

Layout Block - Text

- The maximum tax deduction is €3,200 per taxpayer

- The minimum term of the contract is 10 years;

- The minimum subscription period is 10 years

- The maturity date is no earlier than a beneficiary’s 60th birthday and no later than their 75th birthday

- At maturity, the principal can either be redeemed in full at the time of retirement, or converted into a life annuity payable monthly, or a combination of both. For the R-Vie Pension product, annual withdrawals are possible in addition to redemptions.

- Premiums paid over a year may exceed the deductible limit

- Life annuity payments are 50% tax free

Call to action Large

Layout Block - Infos - Question

We are here to answer your questions and can put you in contact with the right people depending on your requirements.

Contact usLayout Block - Infos - Download

Layout Block - Infos - Agences

Raiffeisen has branches all over Luxembourg, making your life easier! You will be able to find a branch or ATM wherever you are!

Locate our agencies