Submitted by Carole on Thu, 06/08/2017 - 14:10

English

An additional choice alongside your conventional investments

Combining personal protection and savings, R-PlanInvest is built up through regular payments into funds that match your profile.

You make regular payments of the amount of your choice (minimum €50) into the funds proposed by Raiffeisen. The payments are made by monthly, quarterly, half-yearly or annual standing order. To optimise the average acquisition price, we recommend a monthly payment.

The multiple funds put forward by Raiffeisen mean you can choose the funds that best suit your aspirations and your investor profile. The choice is made according to the duration of your savings plan and your appetite for risk.

Your benefits:

- Attractive tax status – No withholding tax for clients resident in the Grand-Duchy of Luxembourg.

- Capital gains - not taxable if the holding period exceeds 6 months.

- Diversification of your savings – Complements cash savings.

- Flexibility – You can stop payments or exit the plan at any time.

- No initial capital required

- Attractive pricing – No custody fees, discount on subscription fees

- Free to choose how often you want to pay in (one-off deposits, monthly, quarterly, every six months or once a year) and how much you want to deposit.

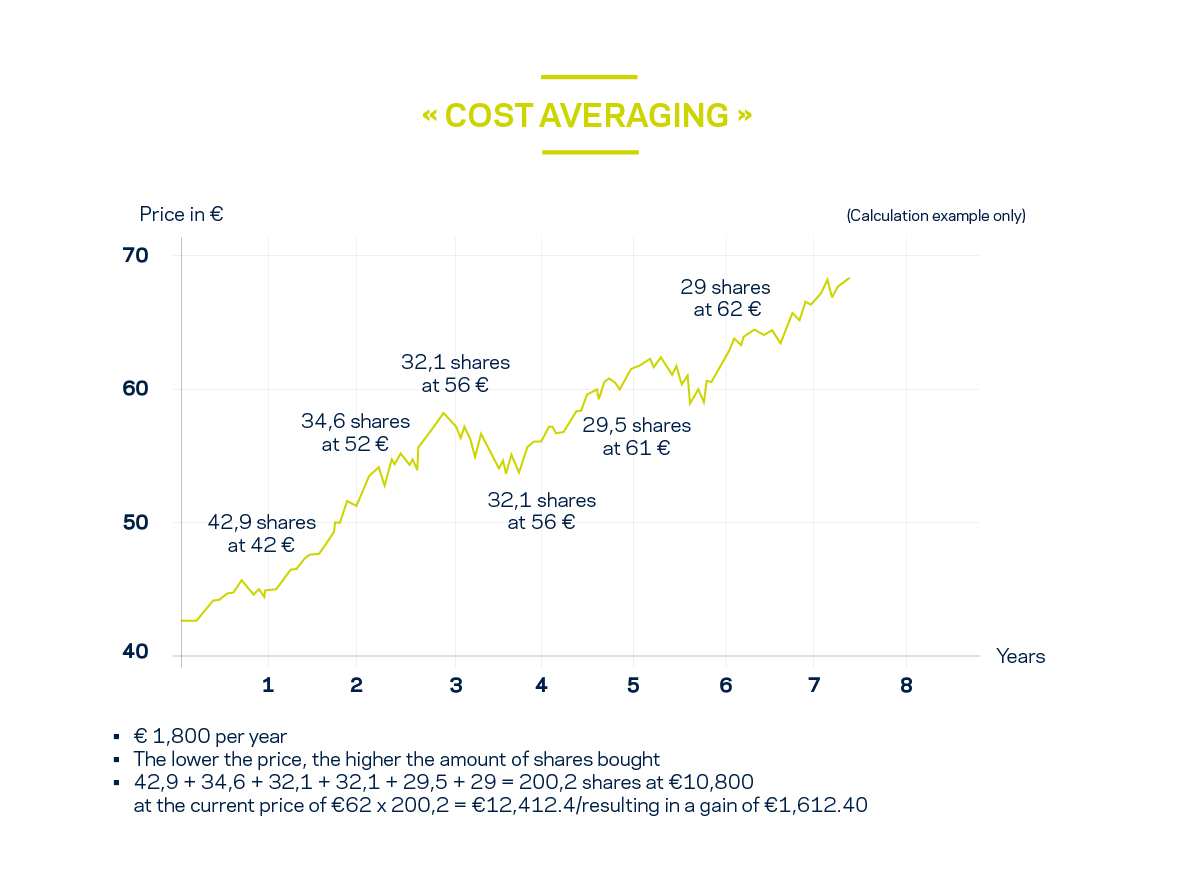

- A levelling-out of acquisition prices – If you invest in a SICAV with regular, stable instalments, you can level out acquisition prices. This ‘Cost-Averaging’ strategy has a positive impact on the average acquisition prices (cost price) by balancing out fluctuations in purchase prices.

E.g.