Banner title

Text with Image - Left

R-Gestion is for investors wishing to benefit from the expertise of our discretionary fund management specialists. When you call on our services, you benefit from a personal advisor who will keep you up-to-date with what’s happening with your portfolio. Your assets are managed according to your risk profile and the selected discretionary management strategy. In addition, you will receive quarterly our ‘Investors’ Outlook’ publication and a statement of various performance indicators and tax reporting on the position of your assets in our books.

You will have access to our ‘investor hotline’ and substantial price privileges.

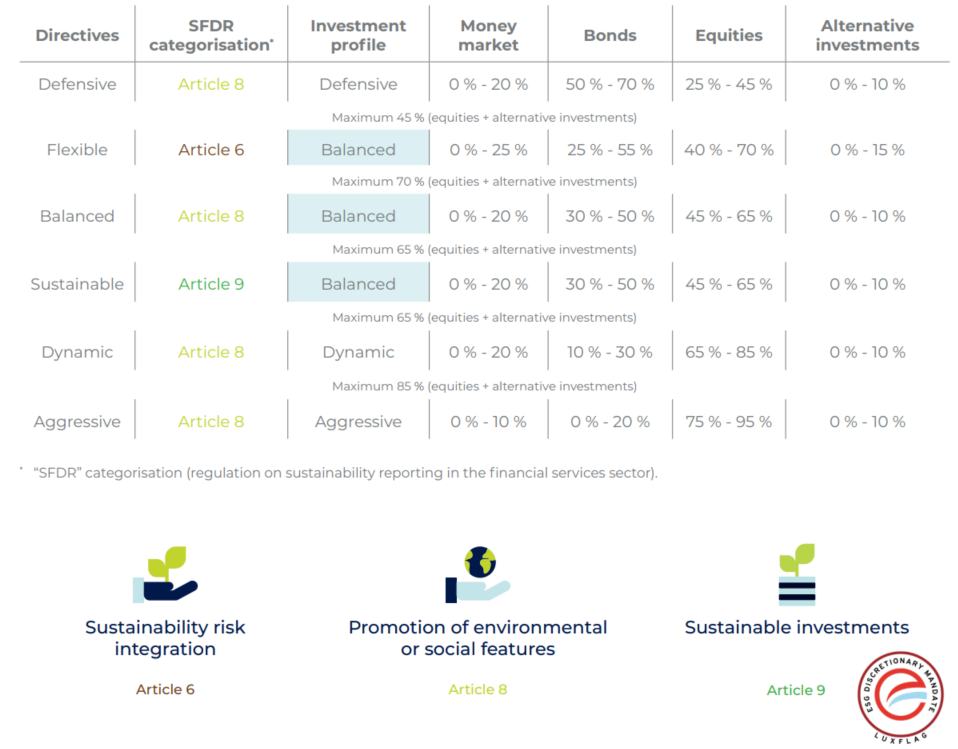

The Sustainable Directive is intended for investors with a medium or long-term investment objective who wish to invest in funds with a positive ecological or social impact.

Qualifying threshold: €125,000

More information about sustainability here.

Layout Block - Green Title H2

Layout Block - Text

Standard rate

- Annual management fee: 0.50% p.a. + VAT (Discount for OPERA PLUS members: 10%)

OR

Performance rate

- Annual management fee: 0.30% p.a. + VAT (Discount for OPERA PLUS members: 10%)

- Performance fee - only applicable if net performance > 2%:(net performance - 2%) x 0.10 p.a. + VAT

Layout Block - Green Title H2

Layout Block - Video

Layout Block - Green Title H2

Layout Block - Text

Layout Block - Green Title H2

Layout Block - Text

The benchmark indices had been defined for each asset class composing the portfolio. The different indices allow the calculation of a global index per investment directive. The quarterly performance of the R-Gestion portfolio is compared to the performance of this global index.

The below scheme contains the different indices per asset class for each investment directive.

The benchmark indices may be identical for several investment directives, but the allocation varies from one strategy to another.

A written plan describing the measures that shall be taken in case of a substantial amendment or disappearance of the indices is constantly kept up to date.

|

Structure by asset class |

Benchmark indices |

|||||

|---|---|---|---|---|---|---|

|

Cash & Equivalents |

FTSE 1 Month Eurodeposit EUR |

|||||

|

Bonds |

Bonds EUR (Bloomberg Euro Aggregate) Global Bonds (Bloomberg Global Aggregate EUR-hedged) High Yield Bonds (ICE BofAML Global High Yield EUR-hedged) Emerging Markets Bonds (JPM EMBI Diversified EUR-hedged) |

|||||

|

Equities |

Europe Equities (MSCI Europe NR) Global Equities (MSCI World NR) Emerging Markets Equities (MSCI EM NR) |

|||||

Layout Block - Text - Table

| Information about the financial products as a Financial Market Participant (FMP) | ||||||

|---|---|---|---|---|---|---|

|

Product disclosures |

Product classification |

Environmental or social characteristics or the sustainable investment objective of the financial product |

Overview of changes in the website disclosures for each financial product |

Website disclosures |

Precontractual disclosures |

Reporting |

| Aggressive | Article 8 hybrid |

The environmental and social characteristics promoted by the financial product consist respectively of:

|

Summary of changes compared to the last version of January 2023 |

|||

| Dynamic | Article 8 hybrid |

The environmental and social characteristics promoted by the financial product consist respectively of:

|

Summary of changes compared to the last version of January 2023 |

|||

| Balanced | Article 8 hybrid |

The environmental and social characteristics promoted by the financial product consist respectively of:

|

Summary of changes compared to the last version of January 2023 |

|||

| Defensive | Article 8 hybrid |

The environmental and social characteristics promoted by the financial product consist respectively of:

|

Summary of changes compared to the last version of January 2023 |

|||

| Sustainable | Article 9 |

The financial product has a sustainable investment objective which, on the environmental side, aims to support climate action and, on the social side, to protect basic human needs. |

Summary of changes compared to the last version of January 2023 |

|||

Layout Block - Green Title H2

Layout Block - Text - Table

| Information about the entity as a Financial Market Participant (FMP) | Brief explanation |

|---|---|

| Sustainability risk policy | This policy explains how sustainability risks are integrated into the investment decision-making process. |

| Consideration of principal adverse sustainability impacts | This document explains the due diligence policies and approaches to consider principal adverse impact of investment decisions on sustainability factors. |

| Statement on principal adverse impacts of investment decisions on sustainability factors | This statement is published on a yearly basis and showcases the actions taken throughout the year to consider the principal adverse impact of the Bank’s investment decisions on sustainability factors. |

| Remuneration policy | The Bank is currently revising its remuneration policy. |

Layout Block - Green Title H2

Layout Block - Video

Call to action Large

Layout Block - Infos - Other product

Layout Block - Infos - Agences

Raiffeisen has branches all over Luxembourg so you will be able to find a branch or ATM wherever you are.

Locate our agencies