Layout Block - Banner benefits - particulier - epargner

Layout Block - Green Title H2

Layout Block - Text

R-PlanInvest is a SICAV investment fund that gives you the chance to aim for higher returns so you can save for your future requirements and projects. The choice of funds available also means you can select the investment policy that best fits your profile.

Text with Image

Combining personal protection and savings, R-PlanInvest is built up through regular payments into funds that match your profile.

You make regular payments of the amount of your choice (minimum €50) into the funds proposed by Raiffeisen. The payments are made by monthly, quarterly, half-yearly or annual standing order. To optimise the average acquisition price, we recommend a monthly payment.

The multiple funds put forward by Raiffeisen mean you can choose the funds that best suit your aspirations and your investor profile. The choice is made according to the duration of your savings plan and your appetite for risk.

Your benefits:

- Attractive tax status – No withholding tax for clients resident in the Grand-Duchy of Luxembourg.

- Capital gains - not taxable if the holding period exceeds 6 months.

- Diversification of your savings – Complements cash savings.

- Flexibility – You can stop payments or exit the plan at any time.

- No initial capital required

- Attractive pricing – No custody fees, discount on subscription fees

- Free to choose how often you want to pay in (one-off deposits, monthly, quarterly, every six months or once a year) and how much you want to deposit.

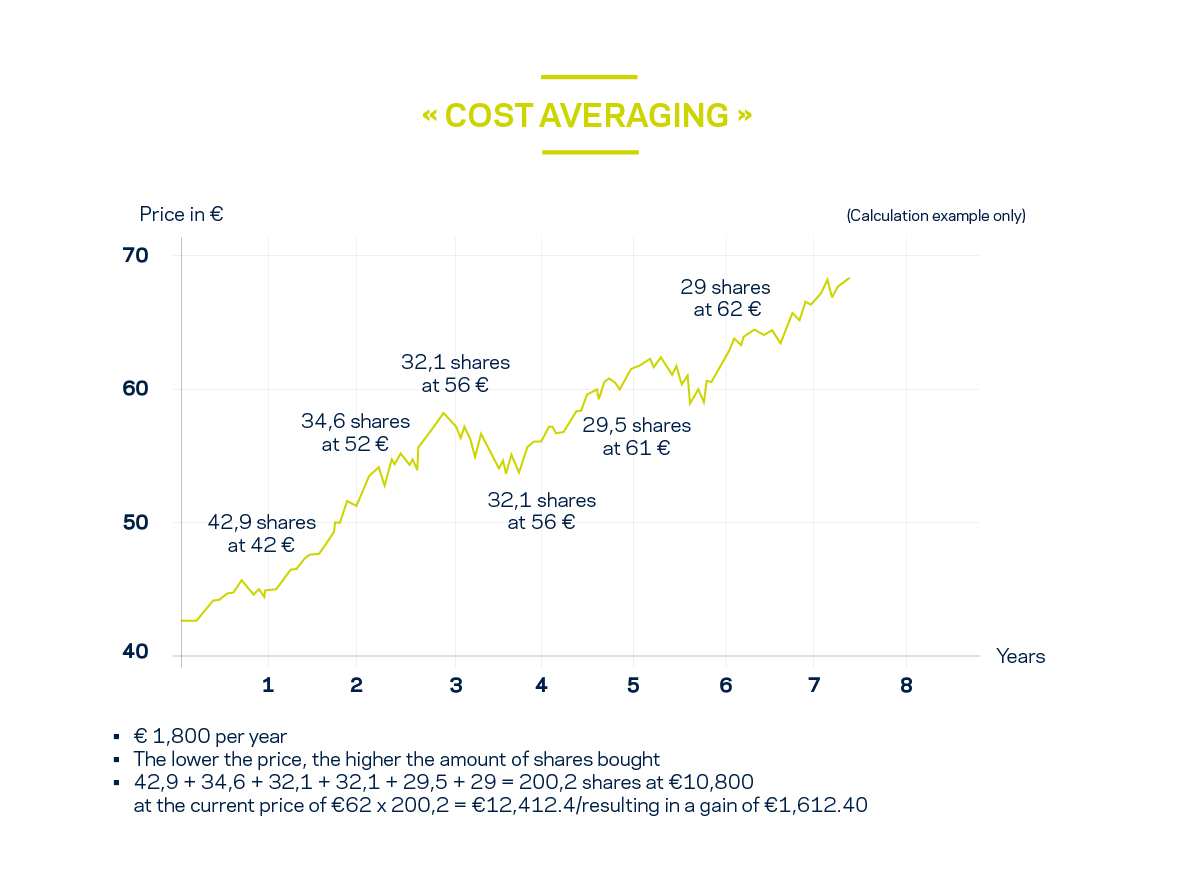

- A levelling-out of acquisition prices – If you invest in a SICAV with regular, stable instalments, you can level out acquisition prices. This ‘Cost-Averaging’ strategy has a positive impact on the average acquisition prices (cost price) by balancing out fluctuations in purchase prices.

E.g.

Layout Block - Green Title H2

Layout Block - Text

| Investment horizon | 5-10 years (depends on the fund selected) |

| Investment choices | Determined by the Investor from the SICAVs offered |

| Minimum amount to save and regularity | €50/Month, €150/quarter, €300/six months or €600/year |

| Supplementary payments | Possible at any time |

| Withdrawal |

Withdrawals possible at any time Cash available in the account in 2-3 days |

| Subscription fee | 1.50% of the invested amount (OPERA PLUS member discount: 20%) |

| Redemption fee | 0.50 % (no minimum) |

| Custody fees | Free |

| Securities statement |

|

Past performance is not indicative of future performance. Investing in an investment fund involves a risk of capital loss. Information on each of the funds is available in the fund's key information documents.

Layout Block - Green Title H2

Layout Block - Text

Tell us how much you would like to invest, for how long and what kind of investor you are (how cautious), and your Raiffeisen advisor will help you find the best solution for you.

Layout Block - Infos - Download

Layout Block - Infos - Question

We are here to answer your questions and can put you in contact with the right people depending on your requirements.

Contact us