Jeff Bezos is going organic - should we do the same? But like Amazon’s chief executive, who did his math before gobbling up the US organic grocery chain Whole Foods, you ask yourself if a more “sustainable portfolio” automatically means less performance.

The answer to that question is simply no. And we are not alone in holding this opinion. Academic research shows that companies that take into account environmental, social and governance standards (ESG) often manage their risks better and post higher profits than their peers, which has a positive impact on the share price. Judging by the growing market share of ESG-oriented products, investors concur with this view.

Investors have always been concerned about how their money is invested. Although ESG is a recently invented term, referring to the inclusion of environmental, social and governance considerations, ESG can trace its roots back to the Victorian era, when a few philanthropic industrialists realised that their businesses would be more successful if their workers were properly housed and given opportunities for education and healthcare. Since then, ESG has grown into today’s diverse range of products and services.

ESG investment has gradually developed and will become mainstream, thanks to four factors:

- Individual investors and institutions wish to make investments that are consistent with their convictions and values.

- Growing transparency and more widely-available access to information on how money is invested.

- Evidence that ESG considerations can both increase returns and reduce risk.

- Investors want to influence how business is conducted.

The volume of assets managed according to ESG principles will continue to grow.

ESG IS NOT A PASSING FAD OR A FASHION, BUT OVER THE NEXT TEN YEARS WILL BECOME AN INTEGRAL PART OF HOW MOST PROFESSIONAL MANAGERS THINK ABOUT INVESTMENT.

Between 1990 and 2000, investors thought that incorporating ESG factors into investment decisions would mean giving up performance. But this way of thinking is outdated. There is evidence that ESG investments can enhance returns by selecting the best-managed companies and avoiding event-relating risks.

An extensive meta-analysis of over 2,000 academic studies on the effect of incorporating ESG factors into investments found strong evidence that ESG improves the risk/return profile of investments. There are three core ways in which the incorporation of ESG criteria can improve investment results.

What are the ESG investment approaches available today?

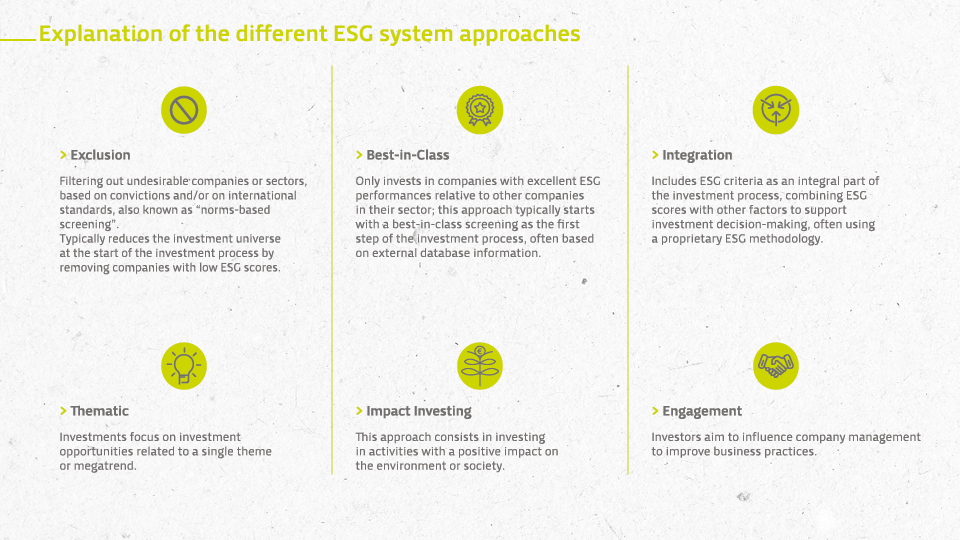

There is a wide range of confusing terminology around ESG today. To avoid confusion, we have defined six categories that we use to describe ESG investments:

- Impact investing

- Thematic

- Best-in-class

- Integration

- Engagement

- Exclusion

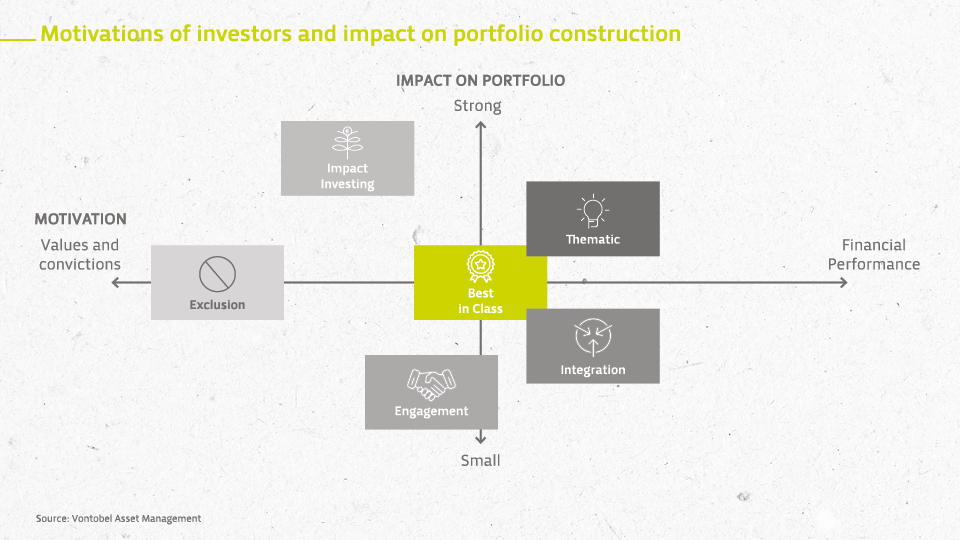

We categorise these six ESG investment approaches according to the motivation for the investment approach and the limits it places on portfolio construction.

The chart below maps these differences: on the x-axis, we show the typical investor motivation, whether driven by values and convictions or by financial performance, while the y-axis shows the degree to which the investment approach constrains the portfolio construction.

For instance, impact investment typically focuses on specific development projects which deliver improvements in living standards to participants and/or lead to environmental improvements. We therefore consider impact investing to have a high impact on portfolio construction, while being motivated by values and convictions, and therefore place it in the top left of the chart. Using the same approach, we mapped the six main ESG approaches in the chart below.

How will my portfolio change if I choose an ESG investment approach?

Most approaches incorporating ESG criteria, by their very nature, have an effect on the strategy’s investable universe and therefore change the portfolio sector allocation, liquidity and tracking error relative to a benchmark. Integration has little or no impact because the portfolio manager considers ESG factors alongside all other analyses, while engagement has little or no impact on the portfolio because it involves influencing company management and is often conducted in parallel with the other ESG approaches.

Application to different asset classes

ESG approaches can now be applied to most asset classes, so that the vast majority of model portfolios can be managed according to ESG standards. While ESG solutions covering equities have existed for many years, solutions covering other asset classes, including fixed income and real estate, are more difficult to implement and require additional expertise to apply ESG principles to the asset class in question. There are also clear limits to ESG approaches due to the nature of the investment and instruments used. For instance, US high-yield bond issuers are primarily energy companies, making it virtually impossible to build a well-diversified ESG portfolio in this segment. Similarly, strategies that invest mainly via derivatives can hardly comply with the requirements of an ESG approach.

Sustainable development at Vontobel

We are active in a wide range of areas and allow our financial experts to apply ESG approaches specific to their asset classes. These include global, regional and thematic strategies. To name a few of our sustainable strategies, we will cite two funds: Vontobel Fundmtx Sustainable Emerging Markets Leaders and Vontobel Fund - Clean Technology.

Our experts are free to invest according to their own ESG approach. The ESG Investment Committee oversees the architecture of all ESG investment products, sets investment thresholds and criteria, and is responsible for the Vontobel sustainable universe. In addition, portfolio managers are supported by an ESG Competence Center comprising six investment professionals fully dedicated to analysing ESG issues.

|

|

Authors |

||

|

Lukas Münstermann |

|

||

| Dr. Eckhard Plink Leiter ESG-Kompetenzzentrum, Vontobel Asset Management |

|

Investing sustainably with RaiffeisenOur product range as of July 2019 |

|

R-Gestion – Directive Sustainable Discretionary asset management with investment funds offering positive environmental and/or social impacts. Once the mandate has been signed, you will be assisted by your dedicated investment advisor and will be able to benefit from many advantages.

R-Conseil / R-Invest ESG Funds - (Environment, Social, Governance) In terms of investment advice, Banque Raiffeisen works closely with its partners to bring you a selection of the highest-quality ESG funds. In addition, our LuxFLAG product range includes ESG-certified funds selected through our “Best Of” fund selection process.

Structured products Banque Raiffeisen offers structured products that meet ESG criteria and have the Vontobel-certified “ACT ESG” label.

Green Bonds A selection of green bonds is also available. |

Would you like to grow your assets while actively contributing to a responsible future and promoting sustainable development?

For more information, call 24 50 - 24 50 to speak to one of our investment advisors, send us an e-mail at info@raiffeisen.lu or simply complete the online form at www.raiffeisen.lu.